DeepSeek能“替代”投顾?一场专业测试引发思考

顾问服务

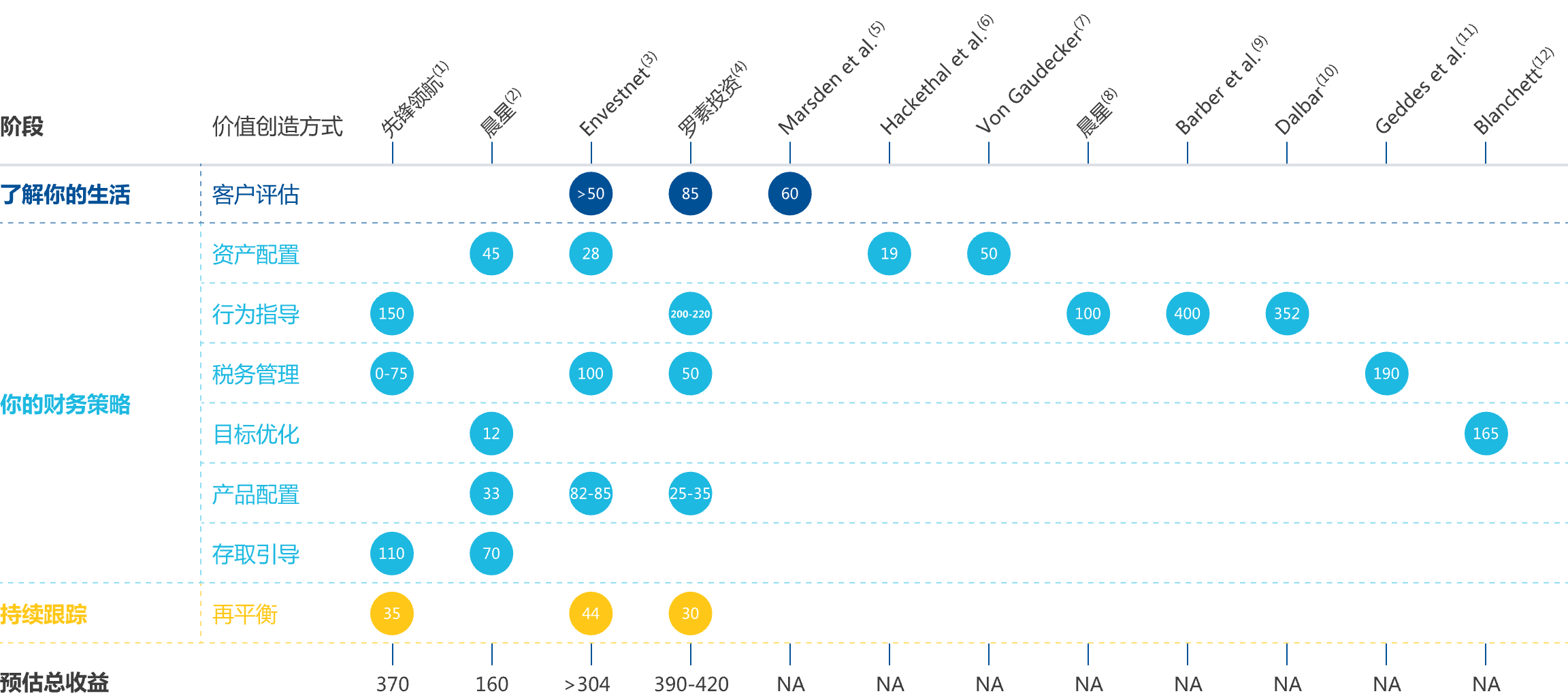

根据海外投顾业务开展的经验,海外多家研究机构发现投资顾问可以给客户带来多方面的价值。

投资顾问创造的价值可分解为七部分,具体包括:[i]资料来源,Vanguard,Putting a value on your value: Quantifying Vanguard Advisor’s Alpha,2022。[/i]

资产配置

低成本的执行

再平衡

行为指导

资产定位

优化投资组合的赎回顺序

总回报投资方法

投资者收益可由阿尔法价值、贝塔价值和伽玛价值三部分构成[i]资料来源,Morningstar,Alpha, Beta, and Now…Gamma,2013。[/i]。投顾通过优选基金创造阿尔法价值,通过设定合理的资产配置创造贝塔价值,并通过提供科学的财务规划和行为指导创造伽玛价值。

资料来源, Merril Lynch,“The Value of Personal Fiancial Advice”, 2016.

(1) Francis M. Kinniry, Colleen Jaconetti, Michael A. DiJoseph and Yan Zilbering, “Putting a value on your value: Quantifying Vanguard Advisor’s Alpha,” Vanguard, 2016;

(2) David Blanchett and Paul Kaplan, “Alpha, Beta, and Now Gamma,” The Journal of Retirement, Fall 2013;

(3) PMC Quantitative Research Group, “Capital Sigma: The Sources of Advisor-Created Value,” Envestnet, 2015;

(4) Brad Jung, Russell Investments, “The Value of an Advisor: Worth More Than 1%,” 2013, “Value of an Advisor Is Still More Than 1%,” 2014, “Value of an Advisor: Once Again, Greater Than 1%,” 2015, and “The value of a tax aware advisor: Where robotics get terminated,” 2015;

(5) Mitchell Marsden, Cathleen Zick and Robert Mayer, “The Value of Seeking Financial Advice,” Journal of Family and Economic Issues, 32(4): 625–643, 2011;

(6) Andreas Hackethal, Michael Haliassos and Tullio Jappelli, “Financial Advisors: A Case of Baby Sitters?” Journal of Banking & Finance, 36(2): 509–524, 2012;

(7) Hans-Martin von Gaudecker, “How Does Household Portfolio Diversification Vary with Financial Literacy and Financial Advice?” The Journal of Finance, April 2015;

(8) Morningstar, “Mind the Gap 2015”;

(9) Brad M. Barber, Yi-Tsung Lee, Yu-Jane Liu and Terrance Odean, “Just how much do individual investors lose by trading?” Review of Financial Studies, 22(2): 609–632, 2009;

(10) Dalbar, “Quantitative Analysis of Investor Behavior,” 2016;

(11) Patrick Geddes, Lisa R. Goldberg and Stephen W. Bianchi, “What Would Yale Do If It Were Taxable?” Financial Analysts Journal, July/August 2015;

(12) Blanchett, David. “The Value of Goals-Based Financial Planning,” Journal of Financial Planning 2015.

备注:“NA”表示该研究仅对某一项单独的基于目标的财富管理(GBWM)方式增加的价值进行估算,而非对整个GBWM增加的价值进行估算。“基点”(basis point)是百分点的百分之一,例如45个基点等于0.45%。

此处识别的创造价值的方式,是美林证券在实施GBWM时最常采用的方式。其他方式虽然未被采用,但可能存在并且对某些客户有益。

除非另有说明,本表所列数值未考虑为实施这些创造价值方式而需要支付的顾问费用的影响。

顾问人员具备海内外顶尖院校背景、扎实的专业功底与过硬的服务能力,通过持续全面的培训,努力保持高服务水准。

基金销售

- 主动股票(含偏股混合)

- 被动股票指数

- 混合资产

- 一级、二级债基

- 纯债

- 现金管理

- FOF

- 量化

- 商品

- REITs

- QDII

- 互认基金

- 全部

- 主动股票

- 偏股混合

| 基金名称 | 基金经理 | 单位净值/万份收益 | 日涨跌/七日年化 | 近一个月 | 近一年 | 今年以来 | 成立以来 | 购买 | 定投 |

|---|

公众号

公众号

公众号

公众号